Are skyrocketing insurance premiums and hidden coverage traps crushing your bottom line?

You deserve insurance that truly protects your business without overpaying.

We drive premiums down on the critical coverage businesses and real estate owners need to protect what they've built.

Texas Business Owners Trust Us Because We Deliver

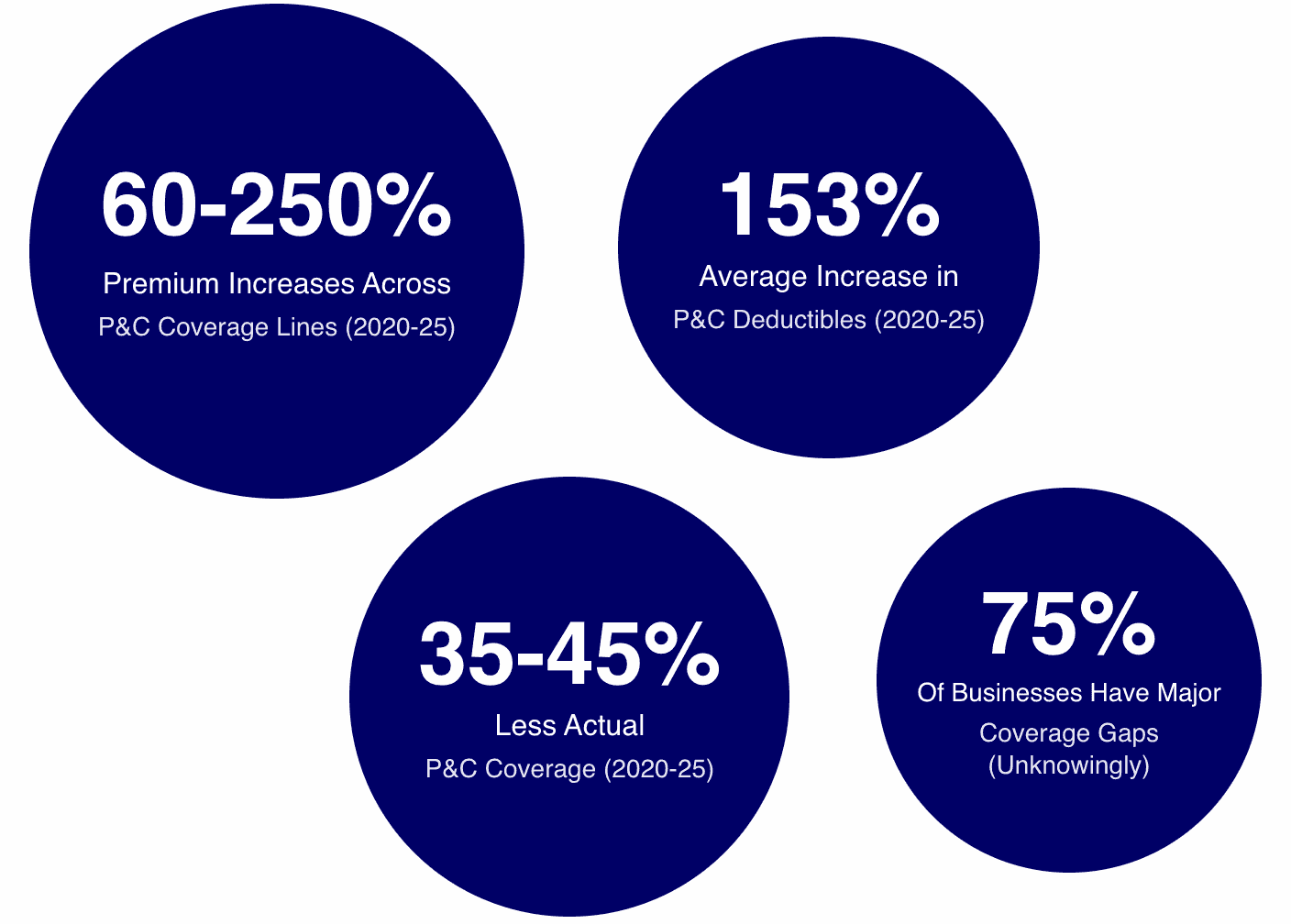

Premiums Keep Rising. Coverage Keeps Shrinking.

You're not alone. Most Texas businesses are stuck with insurance that costs more every year and protects them less. And last-minute renewals and poor communication only add to the stress.

You shouldn't have to decode fine print or gamble with your business.

You deserve clarity, fairness, and coverage that actually holds up.

We Fix Insurance Frustrations Because We Lived Them

Before Harbor & Oak, we spent 20191817161514131211109876543210 years building and operating commercial real estate and running a variety of businesses. We dealt with the same overpriced policies, shrinking coverage, and hidden coverage gaps.

So we did something about it...

We rebuilt our own insurance programs from the ground up. We closed millions in dangerous coverage gaps, strengthened limits where it mattered, and saved hundreds of thousands on premiums in the process.

Now we do the same for you. Smarter coverage. Fewer surprises. Premiums that finally make sense.

Before Harbor & Oak, we spent 20191817161514131211109876543210 years building and operating commercial real estate and running a variety of businesses. We dealt with the same overpriced policies, shrinking coverage, and hidden coverage gaps.

So we did something about it...

We rebuilt our own insurance programs from the ground up. We closed millions in dangerous coverage gaps, strengthened limits where it mattered, and saved hundreds of thousands on premiums in the process.

Now we do the same for you. Smarter coverage. Fewer surprises. Premiums that finally make sense.

When Your Insurance is Done Right

It starts with a line-by-line review of your operations, properties, and policies to uncover hidden risk, real savings, and stronger protection.

Save on Premiums Without Sacrificing Coverage

Rising premiums aren't inevitable. By structuring and presenting your risk correctly to the right carriers, we typically reduce premiums 10–30% while maintaining, or improving, coverage.

Eliminate Costly Coverage Gaps

The most costly losses come from sublimits, exclusions, and coinsurance penalties no one explained. We identify and eliminate those gaps before they become claims—strengthening protection where it matters most.

Expertly Managed, Year After Year

No last-minute renewals. No surprises. We actively manage and re-market your coverage each year, adjusting quickly when better terms become available, not passively auto-renewing.

When Your Insurance is Done Right

It starts with a line-by-line review of your operations, properties, and policies to uncover hidden risk, real savings, and stronger protection.

Save on Premiums Without Sacrificing Coverage

Rising premiums aren't inevitable. By structuring and presenting your risk correctly to the right carriers, we typically reduce premiums 10–30% while maintaining, or improving, coverage.

Eliminate Costly Coverage Gaps

The most costly losses come from sublimits, exclusions, and coinsurance penalties no one explained. We identify and eliminate those gaps before they become claims—strengthening protection where it matters most.

Expertly Managed, Year After Year

No last-minute renewals. No surprises. We actively manage and re-market your coverage each year, adjusting quickly when better terms become available, not passively auto-renewing.

How It Works

Step 1

Step 1

Schedule A Quick Review

We gather your current policies and business information.

Select a date to view available times

Step 2

Step 2

We Analyze & Market Your Account

We identify gaps, savings, and negotiate with top carriers.

Step 3

Step 3

You Get Full Protection at a Fair Price

Enjoy peace of mind knowing your business is covered and your budget is protected